What’s Considered A High Risk Business?

.webp)

Ever faced a rejected payment processor application or been hit with sky-high processing fees without warning? You're likely running what financial institutions call a "high-risk business" – and you're not alone.

This classification isn't about your success potential but rather how banks and payment processors view your risk profile. At FirmEU, we've guided hundreds of entrepreneurs through this frustrating scenario.

In this guide, we'll unpack what makes a business "high risk," which industries commonly face this label, and most importantly, how to thrive despite it.

What Exactly Is a High-Risk Business?

Financial institutions evaluate businesses through a risk assessment lens, categorizing some as "high risk" based on specific criteria. But what does this label actually mean?

But even if your business is considered high risk, this doesn't mean your business is doomed to fail – far from it! It simply means banks and payment processors believe there's a higher chance of financial issues like chargebacks, fraud, or regulatory problems.

Risk assessment happens on multiple levels:

- Industry type: Some sectors automatically trigger high-risk flags regardless of how well you run your business

- Processing history: Previous chargebacks, fraud incidents, or transaction disputes raise red flags

- Financial stability: Inconsistent revenue, seasonal fluctuations, or limited operating history can contribute to risk classification

- Company location: Where your business is registered can significantly impact risk assessment, with certain jurisdictions raising immediate red flags

- Owner/director locations: The residence of Ultimate Beneficial Owners (UBOs) and directors plays a surprising role in how financial institutions evaluate your business

We've seen many successful businesses struggle with this classification. One online subscription service we worked with was profitable and growing steadily, yet still faced high-risk designation simply due to its subscription model.

That's why we don't just help with payment processing—we assist clients in establishing the right corporate structure from the start, significantly improving their chances of being approved by banks and payment processors.

Why banks and payment processors flag certain businesses as high-risk

The hesitation from financial institutions isn't random. They are primarily concerned with protecting themselves against losses.

The merchant category code (MCC) system plays a crucial role here. These four-digit codes categorize businesses for transaction processing and risk assessment. Certain MCCs immediately flag a business as high-risk, affecting everything from transaction monitoring to account approval processes.

The financial institutions' concerns typically fall into three key areas:

- Chargebacks: When customers dispute transactions and request refunds through their banks instead of directly with merchants

- Fraud potential: Industries with historically higher rates of fraudulent activity face greater scrutiny

- Regulatory compliance: Businesses in heavily regulated sectors require more intensive monitoring and due diligence

These factors compound each other—a business facing fraud incidents will likely see increased chargebacks, which may trigger compliance concerns. This cycle quickly escalates risk profiles.

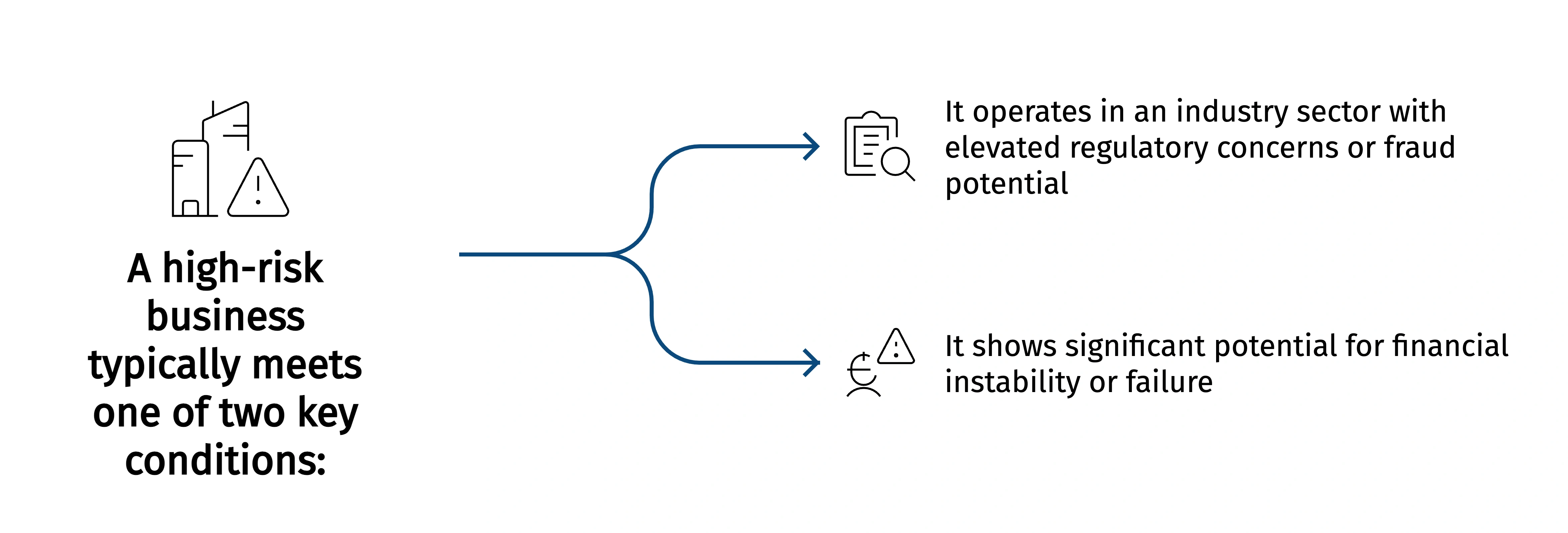

Which Industries Are Typically Flagged as High-Risk?

Certain industries consistently trigger high-risk classifications due to their operational characteristics.

Let's examine the most common ones:

.webp)

Adult entertainment

Running an online adult business comes with its fair share of challenges. From strict age verification rules to high content standards, the industry is heavily regulated. On top of that, credit card processors automatically label adult businesses as high-risk, no matter how well they’re performing financially.

With most transactions being "card-not-present," there's also a higher risk of fraud—and let’s face it, embarrassment-driven chargebacks are pretty common too.

If you're in this space, check out our guide on how to run an online adult business. It breaks down the key policies and liability issues you need to know about. Plus, many adult businesses find it easier to operate in tax-friendly jurisdictions that offer better conditions for growth.

Online gambling and gaming

The gambling sector creates what our risk specialists call "the perfect storm" of high-risk characteristics. In 2023 alone, the Asian gambling industry faced $475 million in anti-money laundering fines.

With huge cash transactions, the possibility of anonymous play, and operations spanning multiple countries, it’s no surprise that staying on top of regulations can be a serious challenge.

CBD and cannabis products

CBD products might be everywhere these days, but they’re still stuck in a bit of a regulatory gray area. The big issue? Quality control.

Subscription services

Recurring billing comes with its own set of challenges, no matter the industry.

Subscription businesses, in particular, deal with higher chargeback rates compared to one-time purchases. Customers often forget about charges, dispute them, or miss canceling free trials before they switch to paid subscriptions.

Travel and accommodation

The travel industry deals with a lot of ups and downs—cancellations, seasonal changes, and advance bookings where services might not happen until months after payment.

Cryptocurrency

Crypto businesses are often seen as high-risk because of market ups and downs, unclear regulations, and the potential for fraud. In 2023, the crypto industry faced the second-highest fines for anti-money laundering violations, just behind traditional banking.

So it’s clear regulators are paying more attention to this space.

Dating services

Dating platforms often rely on subscription models, but managing customer relationships can get tricky. Frustrated users might file chargebacks instead of simply canceling their subscriptions.

On top of that, these platforms can sometimes unintentionally enable romance scams by fraudulent users, leading to potential liability headaches.

Why Your Business Might Be Flagged as High-Risk

Your business practices might trigger high-risk classification even if you're not in a traditionally high-risk industry. So understanding these factors helps you address them proactively.

Regulatory uncertainty can be a real headache. Many organizations struggle to keep up with compliance training and aligning goals across teams. For businesses operating internationally, the web of different regulatory requirements becomes even more complex.

Data protection laws like GDPR add another layer of complexity – our guide to GDPR compliance in payment processing breaks everything you need to know.

Delivery timeline issues frequently trigger risk flags. Delayed deliveries are one of the biggest reasons customers file chargebacks, and there are a few common culprits:

- Production schedules getting thrown off due to capacity issues

- Demand being underestimated, creating fulfillment bottlenecks

- Supply chain disruptions caused by external events

Legal concerns in certain jurisdictions can automatically classify your business as high-risk. Operating in areas with weak regulations or political instability often raises concerns for financial institutions, especially around money laundering or terrorism financing risks.

Business practices that signal higher risk

Specific operational patterns trigger risk flags regardless of your industry:

- High average transaction values: Larger transactions mean bigger potential losses if fraud occurs

- Subscription billing: Recurring charges lead to higher dispute rates when customers forget they signed up

- Free trial conversions: Free trials sound great, but they can backfire. With only about 12% of trials converting to paid users, that leaves 88% potentially disputing charges later.

- International operations: Cross-border transactions face additional scrutiny and fraud concerns

- Limited business history: New businesses lack the track record that builds confidence with financial partners

While we've categorized businesses by typical risk levels, it's worth noting that chargebacks can dramatically change the equation.

The Payment Challenges High-Risk Businesses Face

Once labeled high-risk, your business faces several payment processing hurdles that directly impact your bottom line. Here are some of the most important ones:

- Higher processing fees bite into your profit margins. High-risk businesses typically pay 1.5-3 times more than standard merchants – that's money straight from your bottom line.

- Account stability concerns keep business owners up at night. Sudden termination of merchant facilities can happen with minimal warning, typically triggered by excessive chargebacks or terms violations.

- Cash flow implications hit hard. Payment processors often implement holding periods for high-risk merchants, delaying access to your funds for days or weeks. The nature of high-risk industries often creates irregular cash flow patterns, requiring specialized reserve policies that businesses must review quarterly to maintain financial health.

- International payment complications add another layer of difficulty. Global businesses must navigate different regulatory frameworks, currency conversion risks, and heightened fraud concerns.

Curious about high-risk merchant account fees? Check out our guide for a simple breakdown of fee structures and tips to help you budget smarter.

Banking relationships get tricky

Traditional banks often shy away from working with high-risk industries, leaving legitimate businesses struggling to access mainstream financial services.

The application process is more rigorous and often requires extra documentation and thorough business verification. If you’re looking to open a high-risk merchant account, make sure your website has these key elements:

- A privacy policy page

- Terms and conditions

- Company identification in the footer

- Clear contact information

- Easy-to-find deposit and refund policies

Another challenge high-risk businesses face is reserve requirements. Processors might hold back 5-15% of your monthly sales for 6-12 months, creating a big strain on working capital. Many businesses don’t even know about these reserves until they’re already in place.

As your business grows, the payment system that worked at the start might not keep up. Processors often impose volume caps or trigger additional reviews when processing exceeds certain thresholds, creating potential growth bottlenecks just when you're gaining momentum.

Payment Processing When You're Labeled High-Risk

Despite the challenges, high-risk businesses have more payment processing options today than ever before. Specialized providers have developed solutions tailored to the unique needs of industries that traditional banks shy away from.

Our team frequently sees businesses making costly mistakes by jumping at the first processor willing to accept them, only to face excessive fees or sudden terminations later.

The right payment processor won't just tolerate your industry—they'll have specific expertise in it and offer tools designed for your unique challenges.

Specialized accounts that work for you

High-risk merchant accounts are specifically designed for businesses that don't fit the traditional risk profile. They’re tailored to tackle the specific challenges high-risk businesses face, offering features designed just for them.

.webp)

For example, online gambling businesses need built-in age verification systems, anti-money laundering protocols, and responsible gambling controls. Adult content platforms require multi-payee settlement systems while maintaining privacy for content creators.

If you need help, we’re here to make it easier for you to get and keep a high risk merchant account that works for your business. We've built strong partnerships with payment providers who understand high-risk industries and can provide the right solutions for your specific business model.

Smart ways to lower your risk profile

While you can't change your industry classification, you can implement strategies to improve your risk profile:

Prevent chargebacks

Implement a multi-layered approach to chargeback prevention:

- Clear product descriptions and transparent policies

- Responsive customer service with easy refund options

- Recognizable billing descriptors on statements

- Delivery confirmation for physical products

Our guide on chargeback prevention tips offers proven strategies to protect your processing accounts, so it's worth checking out.

Deploy fraud screening

Make sure to use Address Verification Systems (AVS) to check if billing addresses match credit card records. Besides that, always include a CVV check for every transaction.

You might also want to consider adding 3D Secure authentication for an extra layer of security during checkout.

Always verify customers

Multi-factor authentication for high-value transactions dramatically reduces fraud. Sending one-time passwords via SMS or email ensures customers are using their registered devices.

Plus, address and identity verification tools double-check customer info against databases before payments go through.

Beyond credit cards: Alternative payment routes

Diversifying payment methods is key to building resilience against processing disruptions. For example, crypto payment processing offers significant advantages, such as:

- No limits based on location—send and receive money anywhere

- Lower fees by cutting out the middleman

- Faster payments compared to traditional methods

- A backup option when traditional processors say no

Plus, fiat-to-crypto payment gateways make it even easier to handle these transactions. It’s a great solution for businesses looking for alternative ways to collect payments.

Bank transfers are another great option. They move funds directly between accounts without card networks or intermediaries. This reduces fees and minimizes chargeback risks.

Plus, with real-time payment systems expanding worldwide in 2024-2025, you can now transfer money instantly between accounts at different banks. It’s a great way to keep cash flow smooth and avoid the hassle of payment delays.

High-Risk Doesn't Mean Low Opportunity

Being labeled "high risk" feels discouraging, but this classification simply reflects how financial institutions view processing challenges—not a reflection of your business potential.

The truth? Many high-risk businesses build thriving enterprises despite their classification.

The adult entertainment industry generates billions annually. Cryptocurrency companies revolutionize finance. Subscription services create predictable, scalable revenue streams.

We’re here to take the stress out of “high risk” and turn it into high growth. It’s not just about payment processing—we create payment systems designed around your unique challenges. Whether you’re in adult entertainment, crypto, subscriptions, or any other so-called “risky” industry, we’ve got your back.

So let's find a solution that actually works for you.

FAQs

No. FirmEU is not a bank or financial institution. We operate as an independent matchmaking platform, connecting businesses with verified financial partners. All onboarding, KYC, and approval decisions are handled directly by the financial institution.

Still Have Questions?

Find the Right Banking and Payment Processing Partner for Your Business

Tell us about your company, and we’ll match you with the most suitable global banking or payment providers from our verified network.

%20(1).webp)