What is a High-Risk Business & How to Start One?

Learn what defines a high-risk business, its implications and actionable steps for a successful launch in 2025.

Think running a high-risk business means constant headaches? Spoiler alert: it doesn't have to be - at least not if you know what you're doing.

High-risk businesses come with unique challenges, from finding willing banks to managing fraud, but we've run enough of them to know the ropes.

In this comprehensive guide, we look at what a 'high-risk' really means, which industries get the label (some may surprise you), and how to successfully launch one in 2025.

Determined to start that dream business—even if others call it risky? You’re in the right place. Let's turn the high-risk label into your secret weapon for success!

What does "High-risk business" really mean?

"High-risk business is more than just a buzzword - it's a classification used by banks, payment processors, and insurers to describe businesses that carry increased financial or regulatory risk.

Simply put, a high-risk business is one that financial institutions consider riskier to work with than a typical business. This could be because of the industry you're in, the way you operate or even where you're based.

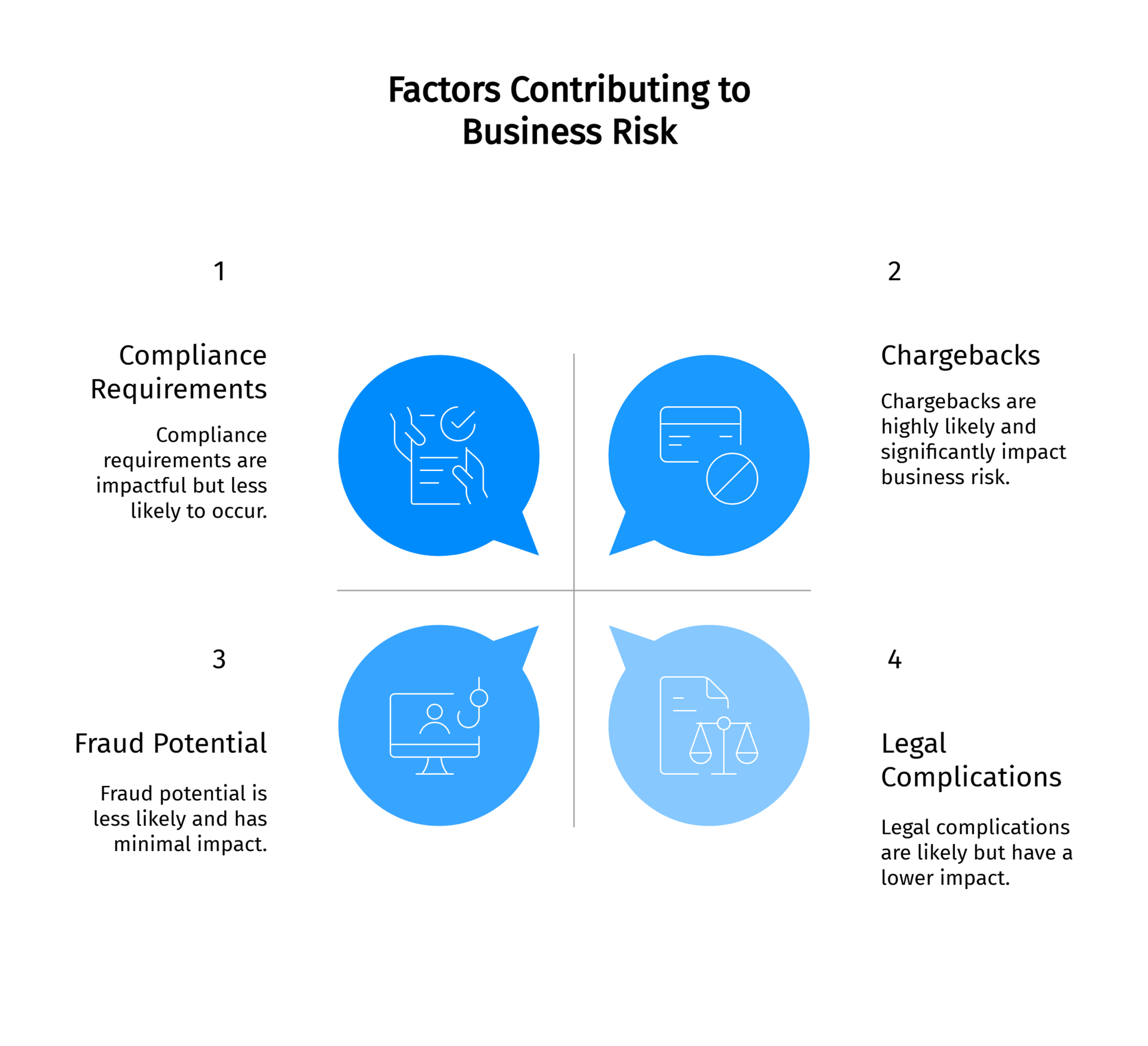

Typical factors that contribute to this classification include:

- Industry type (e.g., gambling, crypto)

- High chargeback rates

- Regulatory scrutiny

- Customer purchasing patterns

- Financial instability

Why would a business be considered high risk?

Often it's because of a higher likelihood of chargebacks, fraud, legal complications or compliance requirements.

For example, an online gambling site or a foreign exchange broker might be considered high risk because there's a higher chance of disputed charges and strict regulations.

Sometimes the label comes from historical data - if businesses in your niche have a history of more payment disputes or more regulatory scrutiny, banks get nervous.

It's important to understand that 'high risk' is not a judgement on the quality or ethics of your business.

It's a way for financial institutions to protect themselves.

In many cases, perfectly legitimate businesses end up with this label simply because they're in emerging or innovative industries (think cryptocurrency in its early days) or use modern business models (like subscription services) that traditional banks aren't used to.

In fact, being high-risk often means you're breaking new ground or operating in a booming market that hasn't yet convinced old-school financiers.

What does that mean for you as an entrepreneur?

Expect a bit more legwork when setting up your business.

Being high risk can affect the way you open a bank account, take out insurance or accept payments.

You may face higher fees, stricter contract terms, or extra paperwork to prove you're running a legitimate business.

But don't let the label put you off.

With the right approach (and the right partners), it is perfectly possible to run a thriving high-risk business.

We've seen clients turn this "risk" into remarkable rewards, simply by understanding the terrain and planning accordingly.

Starting and managing your high-risk business

So you've accepted that your business is 'high-risk'. Now what?

Now we get to work—strategically and intentionally.

High risk doesn't mean impossible.

It means you need to be a little more strategic from the start.

Here are some actionable steps and tips to help you launch and run your high-risk venture successfully:

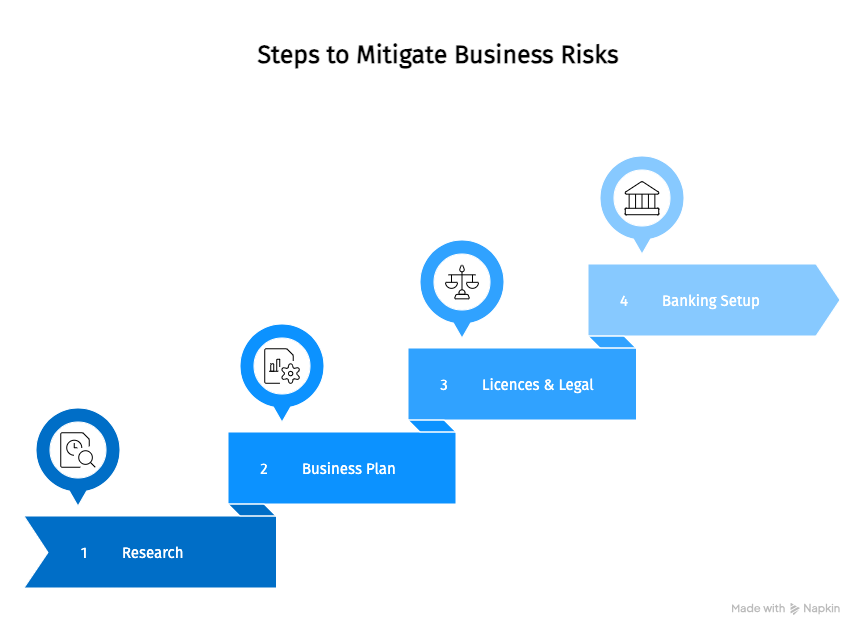

Do your homework (understand the risks)

Start with research. Understand exactly why your industry or model is considered high risk:

- Is it the regulations?

- The history of fraud?

- The nature of the product or service?

For example, if you're starting an online casino, research the licensing requirements and common fraud schemes in iGaming.

Knowing the risk landscape upfront helps you build smarter strategies.

Develop a solid business plan (with risk mitigation)

A typical plan covers your market and revenue model.

A high-risk business plan needs to go further:

- Compliance strategy: How you’ll meet legal and regulatory obligations

- Chargeback mitigation: Clear refund policies and tools

- Contingency planning: What happens if something goes wrong?

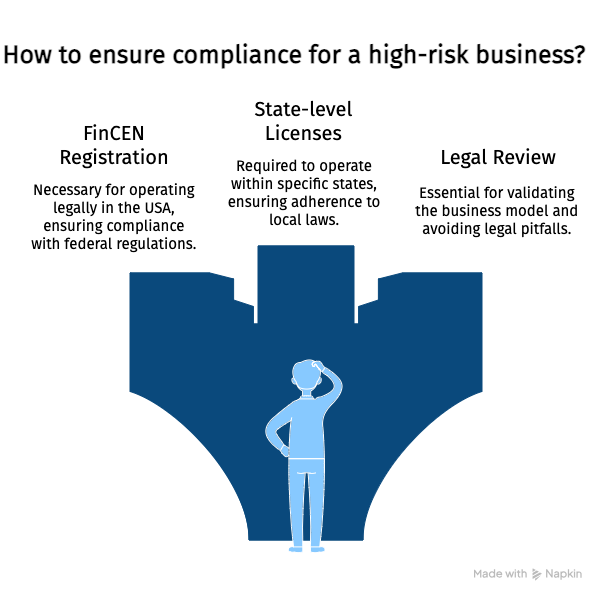

Get the right licences and legal advice

Many high-risk sectors are heavily regulated.

If you’re selling nutraceuticals, make sure products comply with health regulations.

Establish robust financial accounts early on

One of the toughest parts of launching a high-risk business is finding banking partners.

Start early—even before you launch.

- Look for banks or processors with industry experience

- Be ready to share supporting documentation

- Expect a few “no” responses - don’t get discouraged

Persistence pays off.

Firms like ours can help with introductions and fast-tracking applications.

Don’t treat these steps as ‘optional’—they’re your foundation for success.

Implement strong fraud prevention and security

High-risk businesses are often targets for fraudsters.

Put protection systems in place from day one.

This could include:

- Fraud detection software for online payments

- ID verification for large purchases

- Strong cybersecurity: SSL certificates, encryption, security audits

If you're running a digital business, these are non-negotiable basics.

They don’t just protect your revenue—they show payment processors and banks that you take fraud seriously, which boosts your credibility.

The stronger your fraud protection, the lower your risk profile. And that means better terms with banks and processors over time.

Plan for reserves and cash flow management

Most high-risk merchant accounts hold a rolling reserve—a percentage (often 5–10%) of your sales kept for several months.

This helps cover future chargebacks and is completely normal, but:

- It can strain your cash flow, especially early on

- You may not receive a portion of your revenue right away

How to handle it:

- Plan finances with this delay in mind

- Maintain a cash cushion for operating expenses

- As you build a positive track record, you'll be able to negotiate better reserve terms

Focus on customer service and transparency

Want to avoid the classic “high-risk pitfalls”?

Start by keeping your customers happy—proactively.

This includes:

- Clear refund policies

- Accessible support

- Reliable products/services

Every chargeback doesn’t just hurt your profits—it also damages your credibility with payment processors.

Stay compliant and up to date

Regulations change—especially in sectors like crypto, cannabis, or fintech.

If you’re not actively monitoring changes, you’re risking everything.

Stay ahead by:

- Training your team regularly

- Subscribing to industry newsletters

- Joining relevant associations

Stay updated, or get left behind.

Build relationships with the right partners

You’re not meant to do this alone.

High-risk businesses thrive when they build the right support network:

- A mentor who knows the space

- A legal advisor with regulatory expertise

- A consultancy (like FirmEU) that bridges the gap between you and banks

“At FirmEU, we often act as translators—helping high-risk businesses speak the language banks want to hear.”

The right introduction at the right time can turn a rejection into a partnership.

Monitor, adapt and overcome

Managing a high-risk business is not a one-time setup—it’s an ongoing process of monitoring, adjusting, and improving.

Set Key Performance Indicators (KPIs) for your risk management, such as:

- Chargeback rate

- Fraud loss percentage

- Compliance audit results

Review these KPIs monthly.

If something spikes—like a sudden increase in chargebacks—dig into the cause:

- Is it a product issue?

- A fraud attack?

- A communication gap?

Quick action prevents small issues from turning into real threats.

High-Risk Doesn’t Mean Hopeless

Starting a high-risk business may mean jumping through more hoops—but it’s absolutely doable.

In fact, the challenges often produce sharper, savvier entrepreneurs, because they’re forced to think strategically from day one.

“Every obstacle you overcome builds a moat around your business—one that keeps less serious competitors out.”

And remember:

We’ve helped hundreds of high-risk entrepreneurs navigate the journey.

We’ve seen the common pitfalls—and we know how to avoid them.

You’re not in this alone.

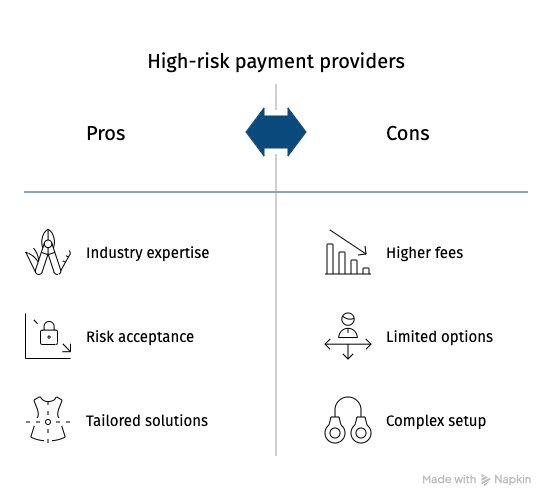

Finding the Right Payment Solution for High-Risk Businesses

One of the most important pieces of the puzzle for your at-risk business is how you'll accept payments.

Whether you're selling products online or providing a service, getting paid (and getting paid smoothly) is the lifeblood of your business.

Unfortunately, this is often where high-risk businesses face the most friction. Traditional payment processors and banks may:

- Turn you away

- Charge sky-high fees

- Impose strict limitations due to your “high-risk” label

But don’t worry—specialised solutions exist, and we can help you find the right one.

Why Payment Processing Is Tricky for High-Risk Businesses

Payment processors like Stripe, PayPal, and major banks earn money from transaction fees.

But a merchant with frequent chargebacks can cost them more than they make.

If a business:

- Accumulates too many chargebacks

- Engages in fraud-prone activity

- Operates in a regulated or misunderstood industry

…processors risk:

- Paying back disputed funds

- Receiving fines from card networks if chargeback ratios exceed thresholds

That’s why many mainstream processors decline high-risk merchants.

And if they do accept you, expect:

- Monthly volume caps

- Rolling reserves

- Higher discount rates (% fee per transaction)

The trick?

Compare your options and know which features matter most to your business model.

Evaluating High-Risk payment providers: What to look for

When choosing a payment provider, don’t just go with the first one that says “yes.”

Compare providers based on the following key criteria:

Industry acceptance

Not every provider works with every high-risk sector.

Ask questions like:

- Have they worked with your specific industry (e.g. crypto, adult, supplements)?

- Can they provide case studies or references?

Pricing & Fees

High-risk = higher fees. But transparency is key.

Compare:

- Discount rate (% per sale)

- Per-transaction fees

- Setup & monthly fees

- Chargeback fees

- Rolling reserves

Avoid providers who hide or delay fee disclosure

Contract terms

Some providers lock you into 24–36 month contracts with high termination fees.

- If possible, negotiate flexible or monthly terms

- Always read the fine print before you sign

Payment methods and currencies

Choose a processor that supports:

- Major cards: Visa, MasterCard, Amex

- Crypto, ACH, e-wallets

- Multi-currency acceptance (e.g. USD, EUR, GBP)

This ensures your business can grow globally.

Integration & Technology

The provider should fit into your tech stack, not fight it.

- Do they support your platform? (Shopify, WooCommerce, etc.)

- Do they offer:

- Virtual terminals?

- POS compatibility?

- API access?

A good gateway should rival the experience of Stripe or PayPal.

Fraud prevention tools

Critical in high-risk sectors.

Look for:

- AVS & CVV checks

- 3D Secure (Verified by Visa)

- Chargeback alerts & fraud scoring

- Customisable fraud rules

These tools don’t just protect revenue—they build trust with banks.

Payout schedule and reserve policies

Ask:

- How often are payouts? (Daily, weekly, bi-weekly?)

- Is there a rolling or fixed reserve?

- When is it released?

A faster payout + low reserve = better cash flow.

Customer support & account management

When you're in a high-risk area, you want responsive support.

Issues are likely to arise (a sudden spike in declines, an account review by the bank, etc.) and you'll need a human being who understands your business to help.

Find out if you'll have a dedicated account manager.

What are their support hours - 24/7 or just business hours?

With time zone differences when operating globally, 24/7 support can be crucial.

We've found that a proactive support team can sometimes even help prevent account freezes - they'll alert you if they see an unusual pattern, so you can address it before the risk department gets involved.

That's a lot to take in.

To make things easier, we often compare providers based on a few core criteria.

Here's a handy comparison checklist (in a conversational way):

Remember, you don't have to go it alone.

Part of our mission at FirmEU is to connect high-risk businesses with the right banking and payment partners.

Over the years, we've built a network of trusted processors and acquiring banks willing to take on clients in high-risk sectors - from adult to crypto and everything in between.

No more cold applications.

No more rejections that hurt your standing. Instead, you get it right the first time, with a provider who’s ready to work with you.

Clear One of the Biggest Hurdles

Finding the right payment solution may take a bit of comparison shopping and negotiation,

but once you secure a reliable merchant account, you’ve already cleared one of the hardest parts of building a high-risk business.

With payment in place, you can focus on growth.

And if a provider ever gives you trouble—like raising fees unexpectedly or cutting you off due to policy changes—we’re here to help you switch fast.

The goal?

Ensure your revenue stream is never at risk.

Turn your high risk status into a competitive advantage

Here's a little secret from our years of experience: being "high risk" can be a blessing in disguise.

Yes, you read that right.

While everyone else is terrified of the label, you can use it to get ahead.

How?

Because high risk often correlates with high reward.

And the very barriers that make things hard for others… can protect you.

Think about it:

- If it’s harder for new competitors to get banked, licensed, or processed

- Then fewer will even try to enter your space

- Those that do… are serious players who’ve passed the test

By launching a high-risk venture and navigating the setup process, you’re already part of an exclusive club.

You’ve done what most wouldn’t dare—and that exclusivity can turn into market share and customer confidence.

Here’s How to Turn “High Risk” Into Your Superpower

Embrace innovation

High-risk industries often emerge from new technology, new products, or new markets.

This gives you one massive advantage:

Think of how venture-backed fintechs pioneered:

- Remote account onboarding

- Crypto payments

- Instant cross-border transfers

Long before traditional institutions even caught on.

Your willingness to operate in this space makes you a trendsetter.

Build exceptional compliance and trust

We’ve seen it again and again:

High-risk companies that go the extra mile with compliance become powerfully credible.

Make your high standards a selling point.

- Promote your security certifications

- Show off your audit results

- Highlight your licensing achievements

If you're running a crypto exchange and manage to secure top-tier regulatory licenses,

you’ll win over customers who are hesitant to trust less transparent competitors.

Compliance isn’t just survival—it’s a competitive differentiator.

Customer service as a differentiator

High-risk industries sometimes suffer from a poor reputation.

(Think: shady payday lenders or fly-by-night supplement sellers.)

But you can break the mould by offering:

- Excellent customer service

- Radical transparency

When you solve problems quickly and ethically, customers notice.

They'll say: “Yes, it’s a tough industry—but these guys are the good guys.”

And that kind of reputation is gold—and nearly impossible for competitors to steal.

Use higher margins wisely

Many high-risk businesses charge premium prices, and rightly so.

- You face higher fees and operational costs

- You also fill gaps where others can’t or won’t operate

Carve out a niche and own it

High-risk often means you're in an emerging or underserved market.

That’s not a weakness—it’s your strategic edge.

Own the niche.

Become the go-to expert and most trusted provider for that specific community.

If you’re one of the only companies in high-risk international trade finance,

use content, case studies, and networking to build an identity of expertise.

Over time, your “high-risk niche” becomes your brand strength,

one that broad, generalist competitors can't replicate.

To illustrate, let's use a hypothetical example.

Imagine two companies: one sells generic, low-risk commodity products, and the other runs a high-risk online gaming platform.

The first has thousands of competitors and razor-thin margins; the second has only a handful of serious competitors worldwide and a dedicated audience that's willing to jump through some hoops to use the service (maybe they have to use a special payment method because not all processors work).

If managed well, the gaming platform can generate huge loyalty and word-of-mouth—gamers will go where the fun is, and if you provide it safely and reliably, they'll stick with you.

Meanwhile, the low-risk business is fighting for attention and slashing prices to win customers.

Who's really in the riskier position?

In some ways, the 'high-risk' business, with fewer competitors and passionate customers, may actually be the safer bet in the long run.

It's all about perspective and execution.

Turning Obstacles into Opportunities

In our own practice, we’ve seen high-risk entrepreneurs flip challenges into advantages over and over again.

Others used strict regulations as a badge of quality:

“If we’re licensed and our competitor isn’t—we lead with that.”

If you see every challenge as a chance to differentiate, your high-risk status will set you apart, not set you back.

Being high-risk means you're doing something different. And different might feel scary—but it's also where innovation happens.

The world is changing fast. In 2025, many “risky” industries are becoming the new normal.

(Remember when e-commerce was considered risky in the '90s?)

By entering early and navigating the rough waters, you're placing your business at the leading edge of the next wave of mainstream success.

Own Your Edge

We’re proud to support high-risk businesses because they’re the pioneers, the risk-takers, the ones who push the boundaries. So:

- Wear your high-risk badge with pride

- Apply what you’ve learned here

- Build smart, act bold—and grow anyway

Now go make your mark - the high-risk way.

How can we help?

Discover the full range of services we can offer with a free quote.