Regulatory Payment Changes [2027]: What Fintechs & Banks Must Know

2027 won’t be just another compliance cycle - it’s a structural reset for the entire payments industry.

The way payments are regulated in Europe and beyond is about to change - dramatically. If your business sends, receives, or processes payments, 2027 will reshape how you operate, manage risk, and stay compliant.

We’ve worked with companies that assumed their existing policies were “good enough,” only to face steep penalties or sudden market exits when they weren’t. Whether you're a fintech startup or a legacy institution, understanding what's coming isn't optional - it's the difference between staying relevant and falling behind.

In this guide, we’ll walk through the most important payment regulations going live in 2027: what they mean, why they matter, and how they’ll affect fintechs, banks, and nonbank providers.

Set aside a coffee or something stronger and let’s get to work.

Why 2027 Is a Turning Point for Regulatory Payments

Not every regulatory shift is worth panicking over. But 2027 is different.

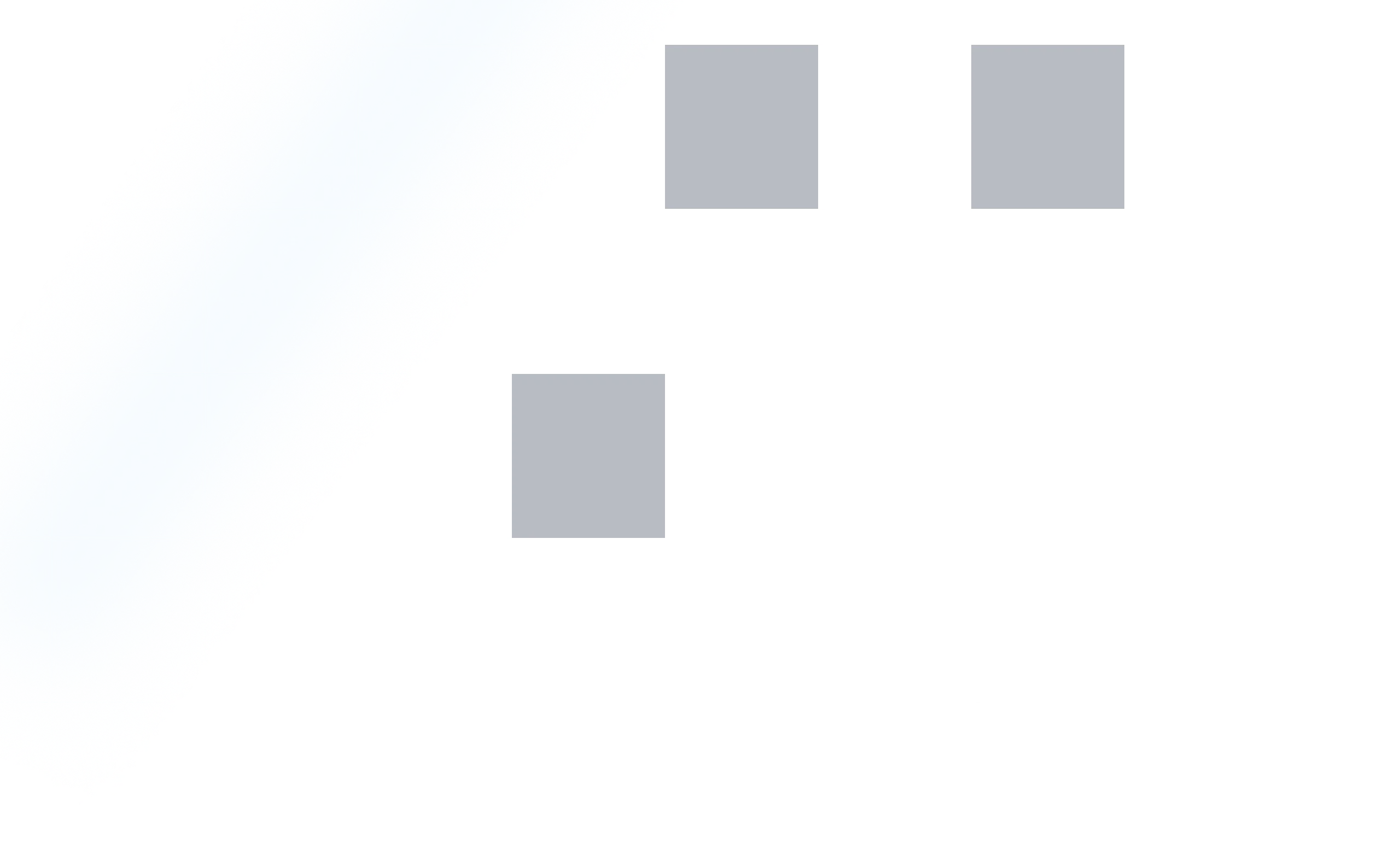

Five major legislative frameworks are coming into force in the EU:

On top of that, there are critical implementation deadlines for ISO 20022, new fraud rules for FedNow in the US, and operational resilience requirements in the UK.

These aren’t minor tweaks—they’re full-system upgrades. Payment flows, authentication methods, fraud detection, data standards, and customer rights are all being rewritten.

PSD3 and PSR: What’s Changing?

Let’s start with the backbone of Europe’s regulatory payments transformation: PSD3 and its sibling regulation, PSR.

Under PSD3:

- Banks will be required to provide one high-quality API for third-party access—no more fallback interfaces.

- Strong Customer Authentication (SCA) rules get stricter. Biometric authentication will play a central role.

- Refunds for unauthorised transactions must happen within 24 hours.

- One-leg-out transactions (where either payer or payee is outside the EU) will now be covered.

PSR builds on this by:

- Standardising reporting formats across all EU states

- Granting broader enforcement powers to regulators

- Replacing fragmented national rules with a single EU-wide framework

Together, they aim to reduce fraud, level the playing field, and make cross-border payments feel local.

What this means for your business

If you’re a fintech offering account information or payment initiation services, your license terms are changing. If you’re a bank or payment institution, your technical standards must catch up.

We’ve seen firms invest heavily in APIs but forget about SCA. That won’t fly under PSD3. Real-time fraud prevention and smooth authentication flows are now just as critical as functionality.

The Instant Payments Mandate (IPR)

The Instant Payments Regulation mandates that euro payments must settle within 10 seconds—and cost the same as a regular SEPA credit transfer.

Key Dates:

- 9 January 2027: You must be able to receive instant euro credit transfers.

- 9 October 2027: You must be able to send them.

The biggest shift? You can’t charge more than for a regular SEPA Credit Transfer. That means new pricing models, new infrastructure, and better fraud defence.

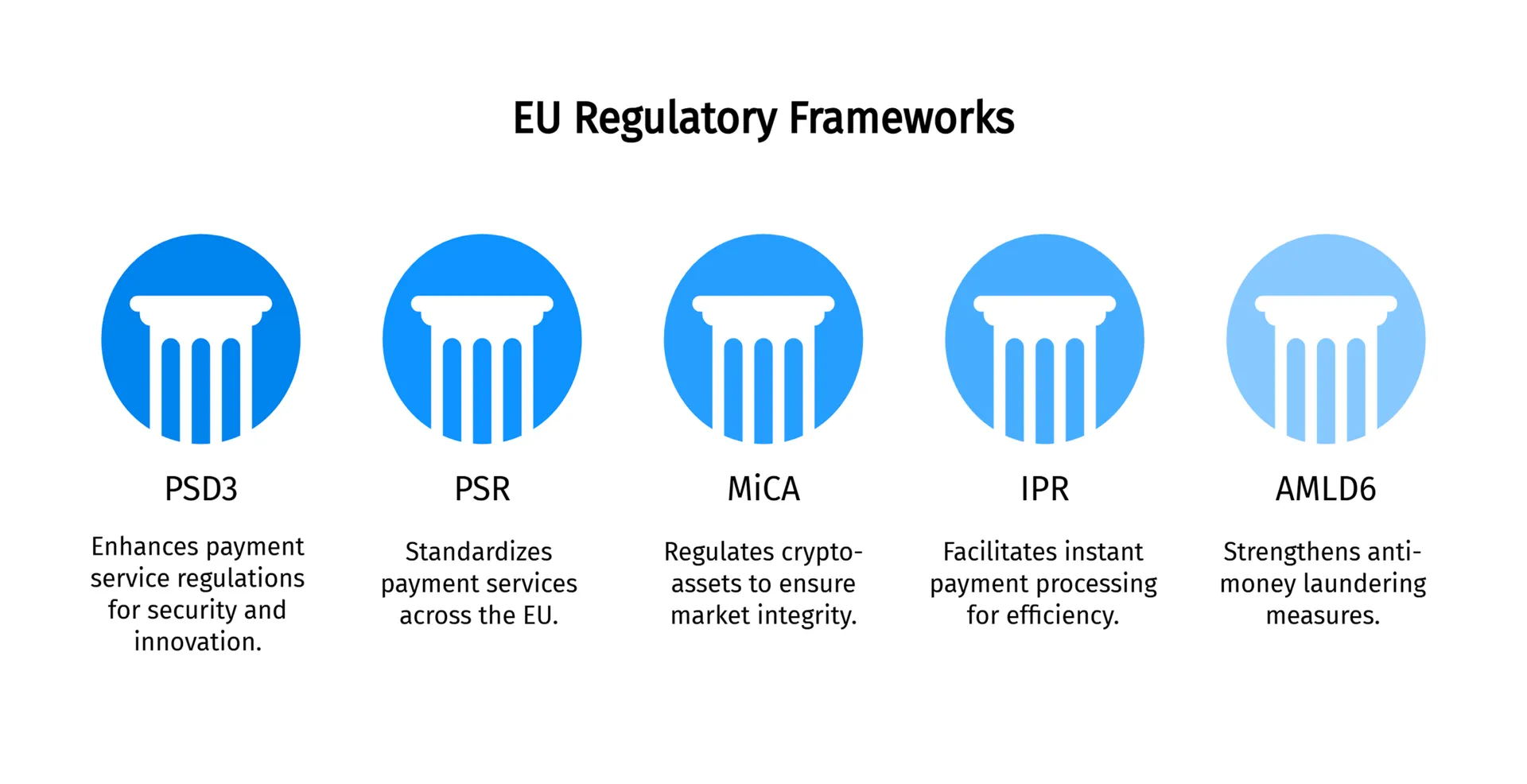

For banks and PSPs, this also means:

- Pre-payment sanctions screening—within milliseconds

- Confirmation of Payee (CoP) mechanisms

- Intraday liquidity buffers to deal with 24/7 fund flows

Instant payments aren’t just a technical upgrade, they're a cultural one. Customers will expect refunds, payrolls, and invoices to move instantly, and that expectation will extend to your brand.

MiCA: Bringing Crypto Into the Regulatory Fold

MiCA (Markets in Crypto-Assets Regulation) introduces Europe’s first comprehensive crypto framework. It brings order to a space long defined by ambiguity.

Applies to:

- Crypto exchanges

- Wallet providers

- Stablecoin issuers

- NFT and token platforms (in some cases)

Crypto is no longer a sideshow.

MiCA introduces the first EU-wide framework for regulating digital assets, covering:

- Custodians

- Exchanges

- Stablecoin issuers

- Wallet providers

If you're navigating token issuance in 2027, check our guide on how to sell tokens without a license under emerging frameworks like MiCA

Under MiCA, these players must:

- Obtain authorisation in one EU state

- Maintain 1:1 reserve backing for e-money tokens

- Publish whitepapers for new issuances

- Comply with the Travel Rule for transfers above €1,000

Why this matters: Institutional investors and banks have stayed away from crypto due to regulatory risk. MiCA removes that excuse if you’re licensed.

Crypto companies will need to show they’re ready to play by traditional financial rules. That includes record-keeping, fraud detection, and customer verification.

We’ve helped exchanges prepare for MiCA by aligning their backend systems with fiat-grade reporting and customer ID standards. It’s not easy, but it’s possible.

AMLD6: Raising the Stakes on Money Laundering

The Sixth Anti-Money Laundering Directive (AMLD6) shifts the burden from systems to individuals. Under this law, senior executives can be held personally liable for AML failures.

You’ll also need:

- Continuous monitoring for adverse media

- Updated internal controls and escalation protocols

- Enhanced suspicious transaction reporting, with tighter deadlines

Companies that treated compliance as a check-the-box task in the past will need to fundamentally rethink their approach.

ISO 20022 and Global Messaging Standards

By November 2027, ISO 20022 becomes mandatory for cross-border SWIFT messages.

This upgrade enables:

- Structured remittance data

- Legal entity identifiers (LEIs)

- Better reconciliation and fraud analytics

For industries facing specific payment processing challenges, such as adult businesses, adapting to ISO 20022 is even more critical.

We’ve seen corporates request ISO 20022-compliant statements from their banks only to find that their ERP systems weren’t ready. Start now, not later.

How This Affects Fintechs, Banks, and Nonbanks

Let’s break it down by segment.

Fintechs:

- Higher upfront compliance costs, especially for SCA and AML.

- Short-term pain, long-term gain: Open banking will become smoother.

- PSD3 opens the door for new services—but closes it to non-compliant players.

Banks:

- Must support ISO 20022 and instant payment rails.

- Can no longer rely on expensive, slow-moving legacy systems.

- Have a competitive edge if they move early on compliance-as-a-service.

Nonbanks:

- Must rethink safeguarding, licensing, and fund segregation

- Have more paths to growth—but fewer shortcuts

Nonbank Providers:

- Safeguarding obligations will align more closely with banks.

- More audit exposure and tougher licensing requirements.

- But: regulatory clarity opens access to more markets.

The Human Cost of Compliance: Why Culture Matters

Technology may enforce policy, but people enforce culture. With regulations like AMLD6 holding executives personally accountable, compliance is no longer the exclusive responsibility of legal departments; it is a shared mindset.

Teams need more than checklists; they need context. When staff understand not just what the rule is, but why it matters, they become part of your internal control system.

Firms that succeed under PSD3, MiCA, and AMLD6 are those that embed compliance into onboarding, performance reviews, and daily operations. That might mean:

- Creating cross-functional fraud response teams

- Running quarterly risk-awareness sessions

- Rewarding compliance-minded decisions, not just revenue growth

A culture of accountability doesn’t stifle growth, it protects it. Especially in high-growth fintechs, where a single oversight can turn into an enforcement headline overnight.

How Regulatory Changes Will Influence Product Roadmaps

Compliance used to be something product managers considered late in the cycle. In 2027, it’s part of the design process from day one.

New rules reshape how products are imagined, built, and launched:

- PSD3's biometric-first SCA influences login flows and onboarding UX

- IPR’s 10-second rule affects queue design and payout logic

- MiCA's licensing structure guides crypto wallet architecture

- ISO 20022’s data richness requires rethinking how payment status is communicated to users

Product teams now need compliance liaisons just like they have designers and QA leads. Smart firms are running cross-functional roadmap sessions that balance user goals with regulatory realities.

A strong compliance foundation doesn’t slow innovation—it unlocks new features that are trustworthy by design.

Preparing for What’s Next

If 2024 was for strategy, 2027 is for execution.

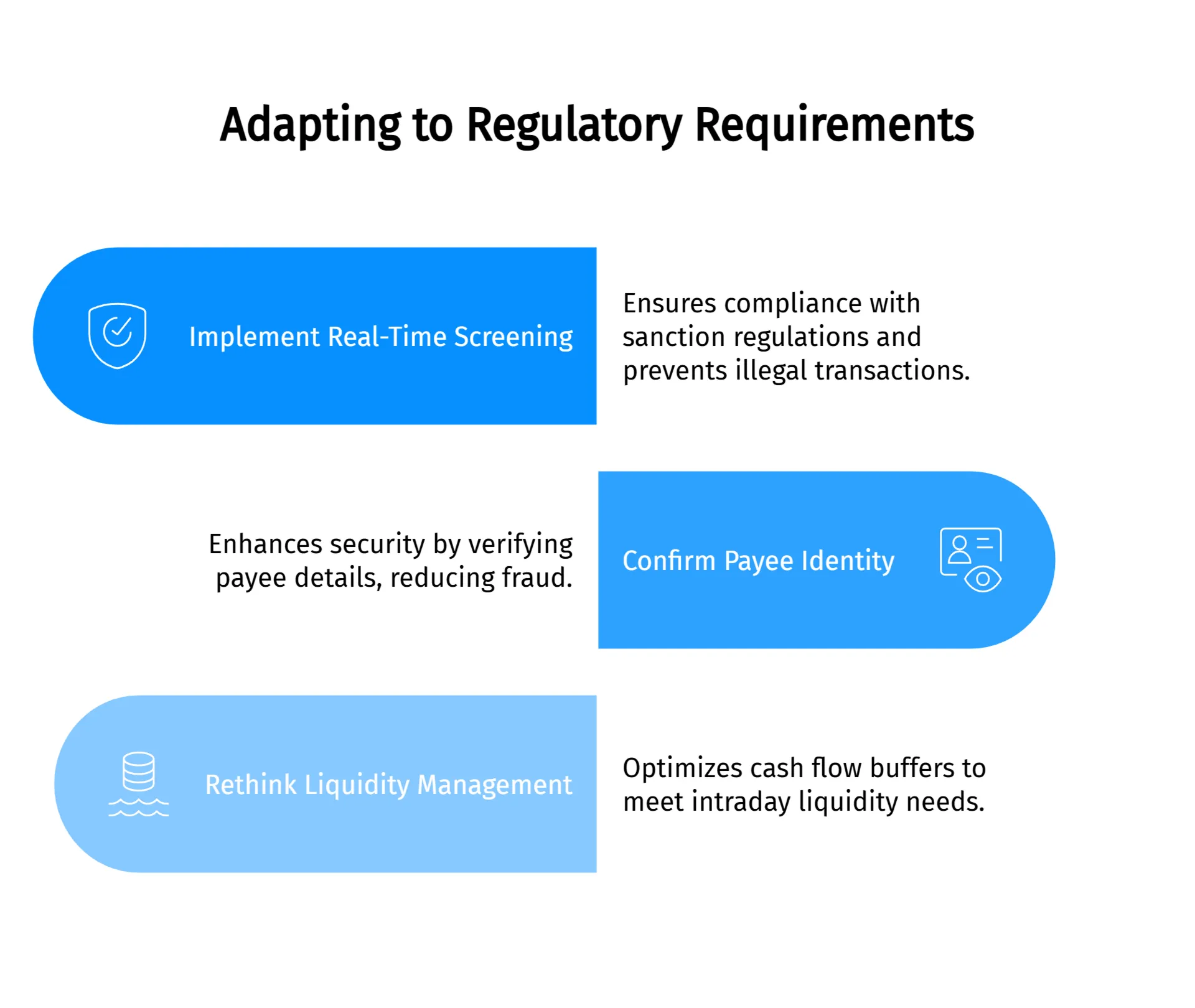

Your action plan:

Staying Compliant Without Losing Your Mind

Here’s what we recommend:

- Audit your payment flows. Where do they intersect with the new rules?

- Upgrade authentication. Biometrics, passkeys, device fingerprinting—it’s time.

- Tighten your fraud detection. Rules-based filters aren’t enough.

- Implement real-time AML tools. Especially if you handle crypto.

- Educate your board. AMLD6 makes them personally accountable.

Compliance isn’t a task—it’s a habit. The companies that thrive under the 2027 regulations are already testing new flows, rewriting terms and conditions, and assigning budgets today.

What Investors and Partners Want to See in a Compliant Business

In 2027, regulatory readiness isn’t just a box on a due diligence checklist, it's a marker of operational maturity.

Whether you’re raising Series B or onboarding a banking partner, your ability to demonstrate. And if you're expanding cross-border, consider setting up in one of the most tax-friendly countries for fintechs in 2027.

- Instant payment compliance

- Secure SCA flows

- Active MiCA or PSD3 licensing

- Real-time fraud reporting

…will directly affect your valuation, timelines, and closing success.

Investors don’t just ask about product-market fit anymore they ask if your infrastructure is legally future-proof.

Startups that wait too long to address compliance will not only face fines they’ll find themselves disqualified from major deals and ecosystem opportunities

You can fight the wave or you can surf it.

We get it. Regulatory changes feel like friction. But the truth is, they often push the market in your favour. The harder it is to be compliant, the fewer competitors survive the transition. If you act early, invest smart, and focus on building trust, regulation won’t slow you down. It will push you forward.

At FirmEU, we’ve helped fintechs, banks, and crypto providers anticipate regulatory trends and adapt before enforcement hits. We don’t just help you survive change—we help you lead through it.

FAQs

No. FirmEU is not a bank or financial institution. We operate as an independent matchmaking platform, connecting businesses with verified financial partners. All onboarding, KYC, and approval decisions are handled directly by the financial institution.

Still Have Questions?

Find the Right Banking and Payment Processing Partner for Your Business

Tell us about your company, and we’ll match you with the most suitable global banking or payment providers from our verified network.

%20(1).webp)