The 8 Safest Payment Methods

Every time you make a payment, there's an inherent risk. Fraudsters and hackers are constantly looking for vulnerabilities, and if they succeed, the consequences can be serious for both consumers and businesses.

Payment card fraud alone reached $33.83 billion in 2023, and this number is only expected to grow, showing just how common and costly these threats have become.

The good news is that there are plenty of reliable solutions to protect your money, as a consumer and as a business.

In this guide, we’ll walk you through the safest payment methods, explain why they matter, and help you make payments more secure.

What Safe Payment Methods Are and Why They’re Important

Safe payment methods are systems for sending and receiving money that are specifically designed to minimize the risk of fraud, theft, or unauthorized access.

They use layers of protection like encryption, tokenization, and authentication to make transactions harder to exploit. These methods can be physical, like chip-enabled cards, or digital, like secure wallets, bank transfers, or payment orchestration platforms.

Why do safe payment methods matter?

No transaction is entirely risk-free. Consumers face threats like identity theft, account takeovers, and stolen funds. Businesses, particularly those in industries with stricter regulatory requirements, face chargebacks, lost revenue, compliance challenges, and long-term reputational harm when payments are not secure.

But the value of safe payment methods goes far beyond convenience:

- Fraud prevention at scale: Strong security protocols such as encryption, tokenization, and two-factor authentication block the most common attack vectors.

- Data protection: Customer and business information stays secure, which is vital in an era where data breaches are increasingly common.

- Customer trust: Shoppers are more likely to complete purchases with businesses they believe will keep their money safe.

- Regulatory alignment: Many secure payment methods are built to comply with PCI DSS and other standards, helping businesses avoid legal and financial penalties.

- Operational stability: Safer transactions mean fewer disputes and interruptions, keeping revenue streams more predictable.

Key takeaway: Safe payment methods are a strategic advantage that protects your money, reduces fraud, and builds long-term trust for both individuals and businesses.

Top Safest Payment Methods

With so many ways to pay today, it’s easy to get confused about which options are actually secure. To help both businesses and consumers make smarter choices, we’ve highlighted the safest payment methods available right now.

These methods are widely trusted and, when used correctly, can significantly lower your risk of fraud, data breaches, and financial loss.

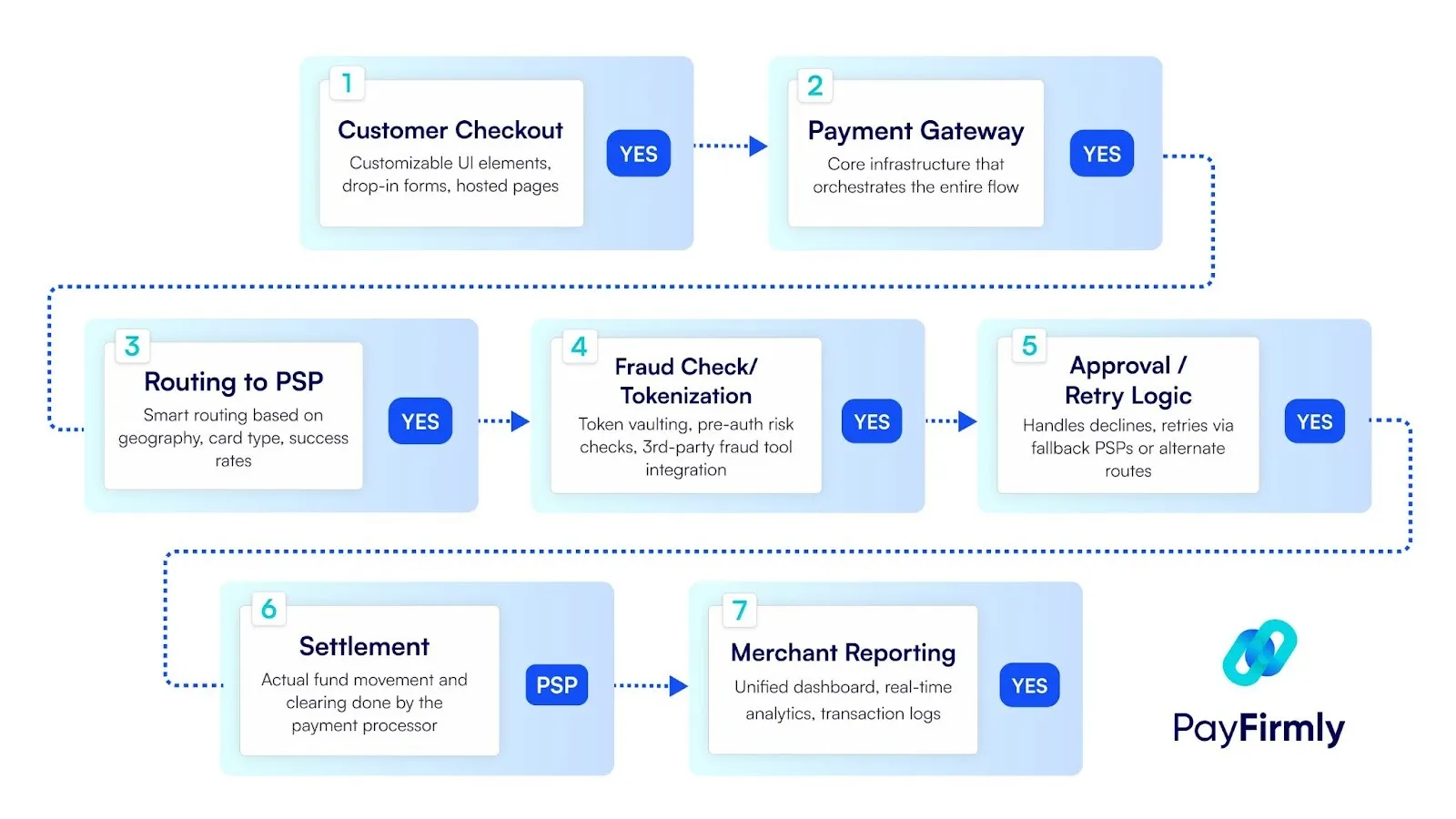

1. Payment Orchestration Platforms

A payment orchestration platform is essentially a central hub for all your payment providers. Instead of depending on just one processor, transactions can be routed through the most secure and reliable option, while fraud detection and compliance tools run in the background.

Why it’s safe: Reduces downtime, avoids reliance on a single point of failure, and applies advanced security measures like encryption and automated fraud checks.

For consumers, this means fewer declined payments and better protection of their card data. For businesses, especially those in industries with stricter regulatory requirements, it brings resilience, higher approval rates, and stronger fraud prevention.

Top players in this category: PayFirmly (designed for regular and industries with stricter regulatory requirements); Zooz (PayU), and Gr4vy

2. EMV Chip Cards

EMV chip cards are credit or debit cards with an embedded microchip that generates a unique transaction code for each purchase. This makes it extremely difficult for fraudsters to copy or clone card data.

Why they’re safe: The dynamic transaction codes protect against counterfeit fraud, and most cards also require a PIN or signature for added security.

For consumers, EMV cards reduce the risk of card cloning and make in-person payments safer. For businesses, accepting EMV transactions helps prevent chargebacks and ensures compliance with payment industry standards.

Where you’ll see them: Most major banks issue EMV-enabled Visa, Mastercard, and American Express cards.

3. Digital Wallets

Digital wallets store payment information securely on your phone, tablet, or online account, allowing fast and convenient payments without sharing card details directly with merchants.

Why they’re safe: They use tokenization, encrypt sensitive data, and often require biometric verification or a secure password, making it much harder for hackers to steal payment information.

For consumers, digital wallets offer faster, safer checkouts and fewer exposed card details. For businesses, they reduce the risk of fraud, simplify payment processing, and boost customer trust.

Examples: Apple Pay, Google Pay, Samsung Pay, and PayPal are widely accepted for both in-store and online payments.

4. Secure Payment Gateways

Secure payment gateways process online payments, acting as the bridge between customers, businesses, and banks. They encrypt sensitive information and verify transactions to ensure funds move safely from buyer to seller.

Why they’re safe: Gateways provide an extra layer of protection, using encryption, fraud detection, and compliance checks to prevent unauthorized access and meet industry standards such as PCI DSS.

For consumers, this means safer online payments and confidence that card details are protected. For businesses, gateways simplify payment processing, reduce fraud risk, and maintain compliance with payment regulations.

Key platforms: PayFirmly, Stripe, PayPal, Braintree, Adyen, and Square, widely trusted for secure online transactions by businesses of all sizes.

5. Cryptocurrency Payments

Cryptocurrency payments allow you to send or receive money using digital currencies like Bitcoin, Ethereum, or stablecoins. Transactions are recorded on a blockchain, offering transparency and decentralization without relying on traditional banks.

Why they’re safe: Blockchain technology makes transactions tamper-proof and irreversible, and cryptography protects against fraud and unauthorized access.

For consumers, crypto payments offer privacy and security when transferring funds online. For businesses, especially industries with stricter regulatory requirements, they reduce chargebacks, lower transaction fees, and provide access to a global customer base.

Top platforms in the category: BitPay, Coinbase Commerce, Binance Pay, Crypto.com Pay, which make it easy for businesses to accept crypto safely.

6. Virtual Cards

Virtual cards are digital versions of credit or debit cards that generate a unique number for each transaction or merchant, protecting your main account information.

Why they’re safe: Each card number is temporary or single-use, reducing the risk of fraud and unauthorized charges. Spending limits and expiration dates add further control.

For consumers, virtual cards make online shopping safer by keeping real card details private. For businesses, they help control employee spending, manage subscriptions, and minimize fraud risks.

Popular providers: Revolut, Privacy.com, Capital One Eno, and Stripe Issuing.

7. Bank Transfers

Bank transfers allow money to move directly from one account to another. Common systems include ACH in the U.S. and SEPA in Europe. They are often used for recurring payments, invoices, and large transactions.

Why they’re safe: Transfers bypass physical cards, reducing exposure to card fraud. Most transfers are protected by bank-level security, encryption, and authentication protocols, making them highly reliable.

For consumers, this means a secure way to send larger sums without sharing card details. For businesses, bank transfers help prevent chargebacks, lower transaction fees compared with cards, and provide clear, auditable records for accounting.

Key examples: Direct online transfers through banks, or services like Wise, Payoneer, and traditional ACH/SEPA transfers.

8. Buy Now, Pay Later (BNPL) with Fraud Protection

BNPL services allow consumers to split purchases into installments while the merchant receives full payment upfront. Modern BNPL platforms include fraud protection tools to verify identity and secure transactions.

Why it’s safe: Advanced verification and monitoring systems reduce the risk of unauthorized transactions, making BNPL a safer alternative to traditional credit for online shopping.

For consumers, BNPL offers flexible payment options with added security. For businesses, it increases conversion rates, reduces cart abandonment, and comes with built-in fraud prevention measures.

Examples: Klarna, Afterpay, Affirm, and Sezzle, widely used for both small and large-scale e-commerce.

Comparison Table: Quick Reference of Payment Methods

We’ve put together a quick reference table summarizing the key features, benefits, and ideal use cases for each payment method, making it easy to compare at a glance and choose the right option for your needs.

Using secure payment methods protects your business and your customers while keeping every transaction smooth and worry-free.

Key Security Principles and Best Practices

Knowing the safest payment methods is only half the battle. To truly protect your money, whether you’re a consumer or a business, you need to follow core security principles and adopt best practices for every transaction.

Use strong authentication

Always enable two-factor authentication (2FA) or biometric verification when available. For businesses, this adds an extra layer of protection for admin accounts and payment dashboards.

Keep software and systems updated

Whether it’s your point-of-sale system, online store, or digital wallet app, regular updates fix security vulnerabilities and help prevent fraud.

Monitor transactions regularly

Check account statements and transaction reports frequently. Early detection of unusual activity can prevent bigger losses.

Limit sensitive data exposure

Avoid storing full card numbers or personal payment info unless necessary. For businesses, use tokenization and encryption to secure data.

Educate your team and customers

For businesses, training staff on secure payment practices reduces human error and insider risks. For consumers, be wary of phishing attempts and only enter payment info on trusted sites.

Choose providers with robust security features

Select payment platforms that meet industry standards, offer fraud monitoring tools, and support multiple secure payment methods. Tools like PayFirmly help businesses centralize payments, route transactions safely, and apply advanced fraud detection, making it easier to implement many of these best practices.

How to Choose the Right Payment Method for Your Business

Choosing the safest payment methods is more than picking one option. It is about building a secure system that protects your revenue and your customers.

This is especially important for industries with stricter regulatory requirements. At the same time, these principles can also help all types of businesses and even consumers manage online payments safely.

1. Understand your risk profile

Industries with stricter regulatory requirements like travel, gaming, or adult services face higher fraud rates and stricter regulations. Knowing your risk level helps determine which payment methods and security measures are necessary.

Learn the key differences between high-risk vs low-risk business.

2. Centralize and orchestrate payments

Platforms like PayFirmly allow businesses to manage multiple payment providers from a single hub. Transactions are routed through the safest channels, while fraud detection and compliance tools run in the background. This improves approval rates, minimizes downtime, and protects sensitive data.

3. Match payment methods to transaction types

Consider what your business handles, such as recurring payments, large invoices, or high-volume online sales. Smaller businesses also benefit from optimized flows and fewer declined payments.

4. Prioritize security and compliance

Choose platforms that meet PCI DSS standards, local regulations, and fraud monitoring requirements. Compliance reduces risk of fines and helps build customer trust, which matters for all businesses.

5. Monitor and optimize continuously

Track transaction success rates, declined payments, and fraud alerts. Regular monitoring helps businesses adjust their payment strategy to ensure smooth and secure transactions.

Future Trends and Emerging Payment Methods

The payments landscape is constantly evolving. As fraud tactics become more sophisticated, new solutions are emerging to make transactions safer and more efficient.

Key trends to watch:

- AI-powered fraud detection – algorithms can spot suspicious activity in real time, preventing losses before they happen.

- Biometric authentication – fingerprints, facial recognition, and voice verification are adding extra layers of security.

- Payment orchestration growth – platforms that centralize multiple providers, like PayFirmly, help businesses with stricter regulatory requirements maintain resilience and compliance.

- Expanded digital wallets and contactless payments – tokenized and fast payment methods enhance security and improve the customer experience.

- Integration with emerging technologies – cryptocurrency, blockchain, and smart contracts provide decentralized security and transparent transactions.

Across the FirmEU network, businesses can explore providers that are adopting these innovations – offering secure, compliant, and future-ready payment options for both industries with stricter regulatory requirements and standard ones.

Conclusion

Choosing the right payment methods keeps your money, your customers, and your business safe.

Through the FirmEU network, businesses with stricter regulatory requirements have been able to discover secure and flexible payment solutions. This includes providers such as PayFirmly, that help manage multiple payment options, simplify transactions, and protect sensitive information while maintaining strong approval rates and compliance.

With secure payment methods in place, every transaction becomes simple, reliable, and stress-free.

FAQs

The safest methods combine strong security, fraud protection, and compliance. Payment orchestration platforms, EMV chip cards, and secure digital wallets are top choices for both consumers and businesses.

Bank transfers are generally secure, especially for large transactions, because they avoid card fraud. Credit cards offer fraud protection and dispute rights, so the safest option depends on your needs and transaction type.

Use trusted platforms like PayFirmly, enable two-factor authentication, avoid saving full card details, monitor transactions, and look for PCI-compliant or encrypted payment systems.

Payment orchestration platforms, secure digital wallets, and certain bank transfers like SEPA or SWIFT provide reliability, currency support, and strong fraud protection for cross-border transactions.

Yes. They use tokenization, encryption, and biometric verification, making them secure and convenient for both consumers and businesses.

No. FirmEU is not a bank or financial institution. We operate as an independent matchmaking platform, connecting businesses with verified financial partners. All onboarding, KYC, and approval decisions are handled directly by the financial institution.

Still Have Questions?

Find the Right Banking and Payment Processing Partner for Your Business

Tell us about your company, and we’ll match you with the most suitable global banking or payment providers from our verified network.

%20(1).webp)